Akhuwat Foundation is a Pakistani non-profit organization focused on poverty alleviation through interest-free microfinance and other social services. Founded in 2001, Akhuwat provides interest-free loans (Qarz-e-Hasna) to individuals lacking access to formal financial services, enabling them to start or expand businesses and improve their livelihoods. Beyond microfinance, Akhuwat also offers education, healthcare, and support for marginalized communities like the transgender community.

Akhuwat Foundation provides different loans to meet specific needs like business, education, marriage, and emergencies. Business loans help entrepreneurs start or grow small businesses. Educational loans support students from low-income families in pursuing higher education. Marriage loans assist with wedding costs. Emergency loans provide fast financial help during crises like natural disasters or medical emergencies.

Akhuwat’s loan program involves the community. Borrowers are encouraged to repay loans in small amounts, promoting responsibility. The program also encourages borrowers to become donors in the future, giving back to the community. Akhuwat’s loan program in Pakistan has helped many people escape poverty, become financially independent, and improve their lives. The program gives interest-free loans and promotes mutual support, making a big impact on Pakistan’s development.

Applying for an Akhuwat loan is simple and accessible, showing the foundation’s dedication to helping people in need. The process includes steps to make sure loans go to deserving candidates who will benefit the most. Here’s a detailed guide on how to apply for an Akhuwat loan:

Akhuwat Helpline

A regular helpline has also been organized in Akhuwat Foundation to provide convenience to the customer. WhatsApp number is also available on this website you will get an official helpline because it is the official website of Akhuwat so if you need any information about loans or loan registration then you can contact immediately helpline number immediately.

Interest-Free Loans in Pakistan

Akhuwat Foundation is a very good organization that has successfully introduced interest-free loans for the first time in Pakistan. Qaraz Hasana or Charitable Loan has created an excellent and comprehensive model keeping in mind Islamic principles which is completely free of interest. Contact on Give Helpline

Best Foundation

In 2025, a complete survey was conducted across Pakistan in which the name of Akhuwat Foundation stood out and won the first position across Pakistan and was crowned as the best foundation, and its founder was awarded the Nobel Prize. And our effort will be to keep his name at the forefront of all the organizations in Pakistan.

Akhuwat Loan Helpline 0370-7671071

Step 1: Initial Inquiry

To start, go to the nearest Akhuwat branch. They have many branches all over Pakistan, so it’s easy for people from different areas to use their services. At the branch, ask about the types of loans and get the details for applying.

Step 2: Eligibility Check

Before filling out the application form, it’s important to ensure that you meet the eligibility criteria. Akhuwat Foundation typically requires that applicants:

- Be Pakistani citizens.

- Have a genuine need for financial assistance.

- Have a viable business plan (for business loans).

- Show a commitment to repaying the loan.

Step 3: Documentation

Prepare the necessary documents to support your application. These documents generally include:

- National Identity Card (CNIC) copy.

- Proof of residence.

- Business plan or educational records, depending on the type of loan.

- Income verification documents.

Step 4: Application Form

Fill out the Akhuwat loan application form accurately, providing all required information. This form can be obtained from the branch or downloaded from our website. Ensure that you detail your financial needs and plans for utilizing the loan effectively.

Step 5: Submission and Initial Review

Submit the application form and required documents at the Akhuwat branch. The staff will review it to make sure you have provided all the needed information and documents.

Step 6: Field Verification

Akhuwat’s field officers will visit your home or business to check if you qualify for a loan. This helps Akhuwat know more about your situation and decide if you can get the loan.

Step 7: Loan Approval

After verifying your application, a loan committee will review it. If approved, you will be informed about the loan amount, terms, and conditions. Akhuwat values transparency and will clarify all parts of the loan agreement for you.

Step 8: Distribution

After you agree to the terms, we will give you the loan quickly. Akhuwat makes sure the process is fast and efficient so you can get the money without delays.

Step 9: Utilization and Monitoring

After getting the loan, it’s important to use the money for its intended purpose. Akhuwat Foundation may check how the loan is used and offer help if needed. This helps make sure the loan is used for things like starting a business, paying for education, or handling emergencies.

Step 10: Repayment

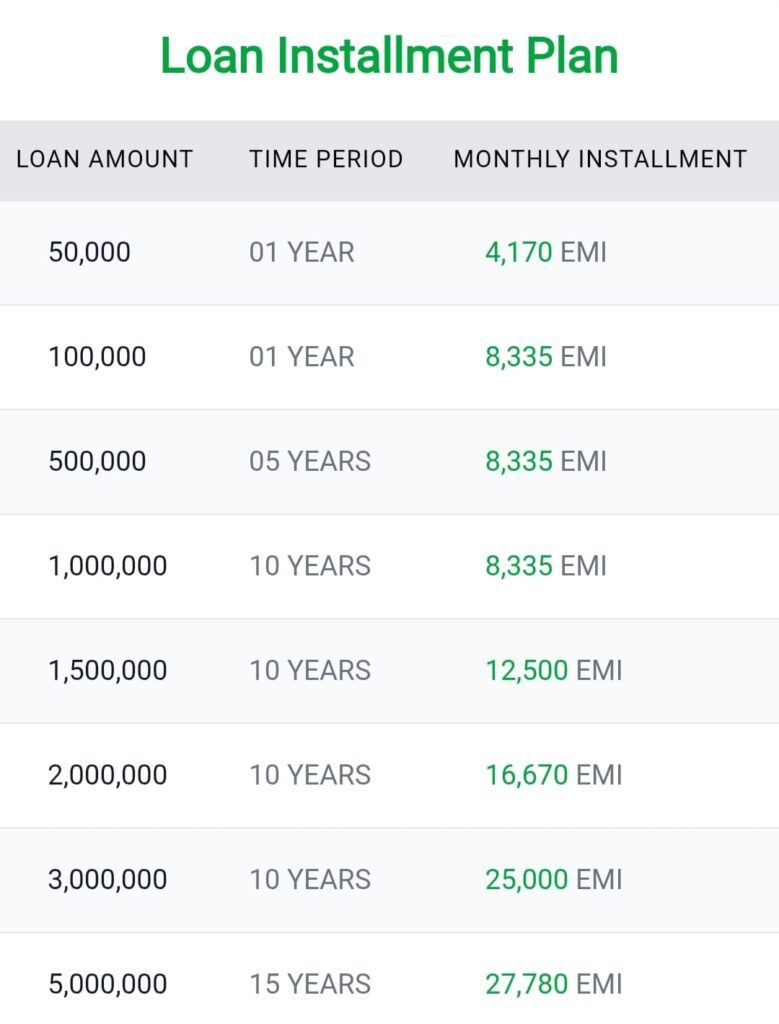

Borrowers can repay in small, easy installments without financial stress. Akhuwat’s interest-free model lets you repay only the principal amount, building trust and community support.

Detailed Overview of Akhuwat Foundation Loan Types

Akhuwat Foundation provides different types of loans to help people and communities in Pakistan. These loans are made to solve financial problems and help borrowers improve their lives. Here is a detailed overview of the different loan types provided by the Akhuwat Foundation.

Coverage of Medical Costs:

Loans cover a wide range of medical expenses, providing comprehensive support.

No Interest: As with all Akhuwat loans, health loans are interest-free, ensuring affordability for the borrowers.